E-wallets are one of the most popular – and divisive – digital payment systems. Despite its detractors, the e-wallet market is anticipated to more than fivefold within the next four years, with as many as one in every two individuals using one by 2025.

Since then, e-wallets have increased their service offerings. WeChat Pay from Tencent can be used to pay for public transport as well as cross-border ecommerce purchases. Venmo, which is owned by PayPal, also allows users to publish their transactions on Facebook, Twitter, and Foursquare via social network interfaces.

Insurance is one subject that has recently piqued their interest. The value proposition is straightforward: embedding insurance in digital transactions provides insurers with instant access to potentially millions of e-wallet customers. E-wallets bring clients one step closer to the “one-stop shop” solution they seek. All signs point to success as insurance agreements with e-wallets take momentum.

Asia’s e-wallet craze is just heating up

Numerous e-wallets are forming insurance agreements with insurtech firms and insurers, and no region is more prepared to ride the e-wallet wave than Asia.

E-wallets are already used on a regular basis by 46% of Asia-1.8 Pacific’s billion online population. Between 2017 and 2019, the number of e-wallet users in Southeast Asia increased from 500 million to 2.1 billion.

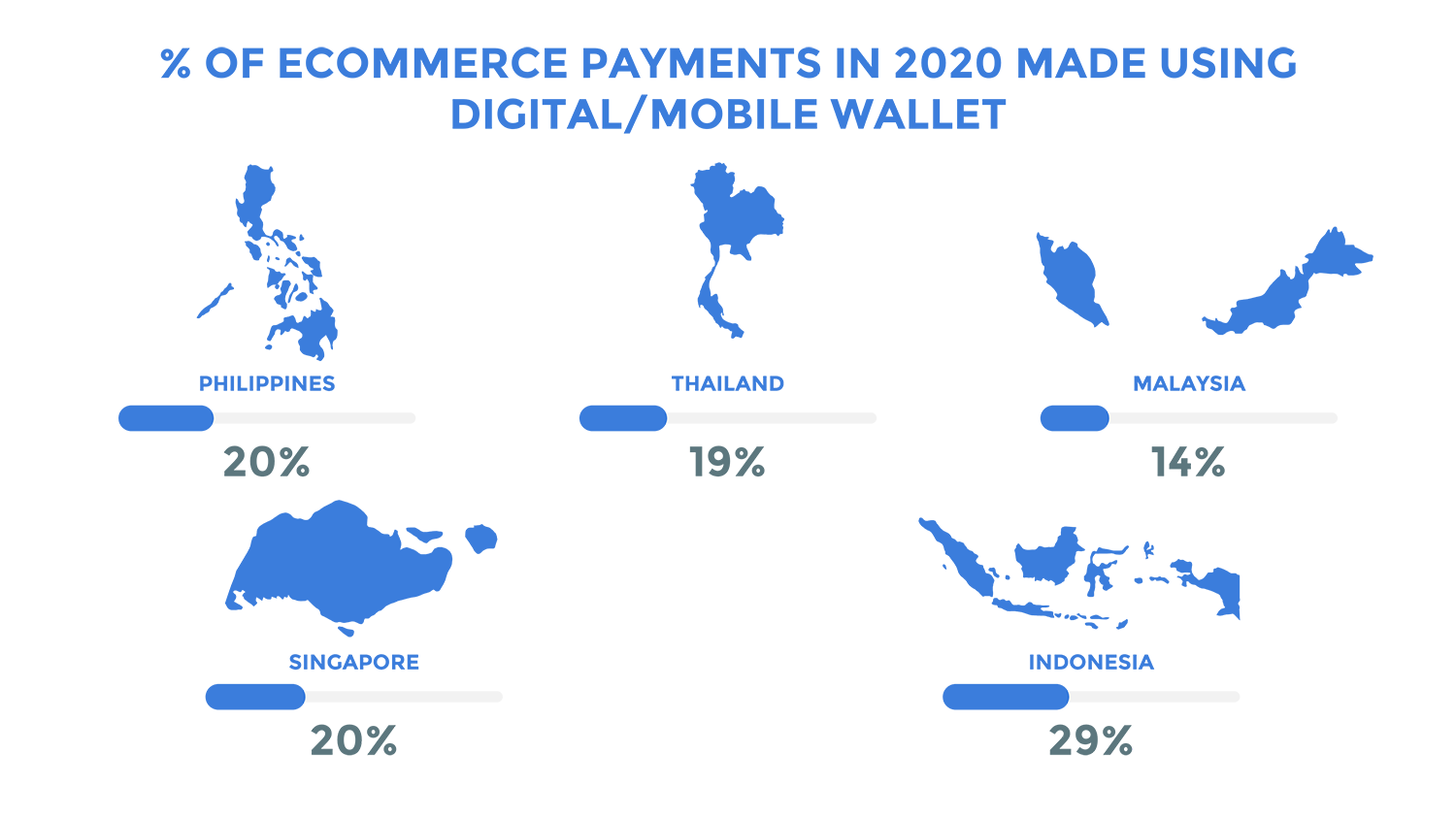

The popularity of e-wallets in Asia is fueled in part by the region’s ecommerce boom. Asian ecommerce income is predicted to account for more than 60% of the global ecommerce market by 2024, according to Statista. Certain ecommerce markets, such as Vietnam, are predicted to rise by double digits this year.

Internet and mobile connectivity are also improving throughout the region. Smartphone ownership is predicted to exceed 80% in APAC by 2025, and 9 of 16 Asian countries are “5G-ready.” Following the wave of increased connectivity, digital payments in Asia are expected to skyrocket in the near future.

Source: WorldPay Global Payments Report 2020

There are already a rising number of competitors vying for a piece of the e-wallet pie. Regional estimates are lacking, although country-specific numbers can be used to extrapolate. According to a 2019 analysis by Fintech Malaysia, there are roughly 53 e-wallets in the country, with the largest one – Touch n Go eWallet – having significantly superior brand awareness among consumers.

In the region, e-wallet users are primarily urban consumers under the age of 35, with 49% of commercial bank customers using one. In Malaysia, for example, 71% of Malaysians in Generation Z utilised e-wallets in 2020, compared to 43% of baby boomers.

A golden opportunity for insurance partnerships

As competition intensifies, e-wallets seek to increase client loyalty by expanding their services with supplementary features. One such aspect is the ability to provide users with digital insurance options.

There are numerous approaches to include insurance into the e-wallet equation. Several collaborations, such as Curv’s 2019 work with German insurance Munich Re, aimed on insuring against cyber assaults on e-wallets. Touch n’ Go eWallet’s early this year relationship with AIA Malaysia, on the other hand, provides Touch n’ Go eWallet users with custom-tailored digital insurance options.

The latter has been the case in the majority of Asian collaborations. In this regard, digital insurance can refer to general internet buying as well as more personal insurance such as personal accident protection and long-term healthcare insurance.

E-wallet providers can offer customised insurance plans that are either personalised based on client spending data or tailored for specific purchases in the form of integrated insurance by partnering with insurers or insurtech enterprises.

According to Singtel International Group CEO Arthur Lang, including digital insurance under Singtel Dash allows consumers not only “complete management of their finances,” but also the convenience and “flexibility of managing their insurance protection coverage.”

For example, Dash PET, the company’s new personal finance management product, combines all-in-one insurance with a savings component and on-demand protection.

Consumer-facing insurers and insurtech providers profit as well, as they gain a new distribution channel through which to promote insurance products and services to customers at a cheaper acquisition cost.

When Singapore’s FavePay partnered with PayLah, PayLah users could make payments by scanning FavePay QR codes. This boosted FavePay’s user acquisition, which credited over 25% of new users to their partnership with PayLah. Similarly to FavePay, insurers can form relationships with e-wallets by using a distinct and complementary user network.

In other news, Ovo, a local e-wallet provider, has collaborated with Prudential Indonesia to offer a digital sharia life insurance product. Prudential Indonesia will be able to access into Ovo’s 110 million-plus user base across the country at a far cheaper acquisition cost as a result of the move.

What makes insurance collaborations with e-wallets so appealing? One problem is that insurers’ product-driven approach is too sluggish to react to changing client needs. Insurers are better positioned to respond to customer preferences and adjust their insurance solutions by combining the powerful digital reach of e-wallets with their insurance knowledge.

Speed bump ahead?

But, there may be obstacles that derail possibilities for insurance relationships with e-wallets.

For one thing, there are still examples of e-wallet fraud and theft. Although client trust in e-wallets has increased dramatically since 2015, reservations remain. Trust has a significant impact on user happiness with e-wallets, hence it is critical that e-wallets continue to spend extensively in cyber-security in order for insurers to consider a cooperation.

It is also becoming more difficult for new e-wallets to enter the market. Rules in the sector are tightening, particularly in China, and it’s generally a winner-take-all market in countries where e-wallets are widely used – the top two operators alone account for more than 80% of the market. For insurers, this could mean fewer opportunities for collaboration with e-wallets.

That may still be a few years away, given that some regions, such as Southeast Asia, are still seeing a flood of new immigrants.

For the time being, the opportunity is clear: insurers and e-wallets may both benefit from an insurance collaboration. It is best to move quickly.